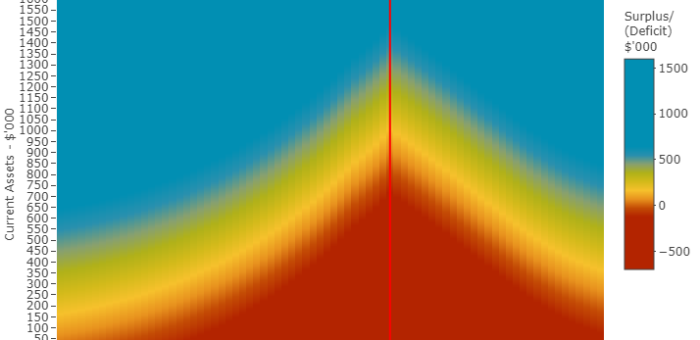

Using risk optimisation techniques gained from over 25 years experience in aggregating insurance risks, connectingthedots is able to "cherry pick" the ASX and apply the same techniques to investment portfolios.

This gives an average return for Australian equities of 26.1% per annum since 2017 with 30.0% in the last year. This is achieved by applying our Investment Strategy and by systematically optimising the risk-return balance at a portfolio level over regular time periods. When managed actively, these returns can be boosted by an additional 10-20% p.a.

Our cumulative performance is set out in more detail in the chart following (passive strategy):

This performance compares more than favourably to that for all MySuper funds with an average of 7.9% for 2023.

This methodology is reflected in our Corporate Investment Strategy.

Access to these returns is only available to our shareholders and employees via our superannuation fund.

All our applications are built in R using shiny-server. Consultation services are available to wholesale and corporates via our contact form.